A Biased View of Paypal Business Loan

Wiki Article

The 7-Second Trick For Paypal Business Loan

Table of ContentsHow Paypal Business Loan can Save You Time, Stress, and Money.The Greatest Guide To Paypal Business LoanLittle Known Questions About Paypal Business Loan.The Facts About Paypal Business Loan RevealedLittle Known Questions About Paypal Business Loan.Paypal Business Loan Fundamentals ExplainedPaypal Business Loan Things To Know Before You BuyThe 25-Second Trick For Paypal Business LoanNot known Facts About Paypal Business Loan

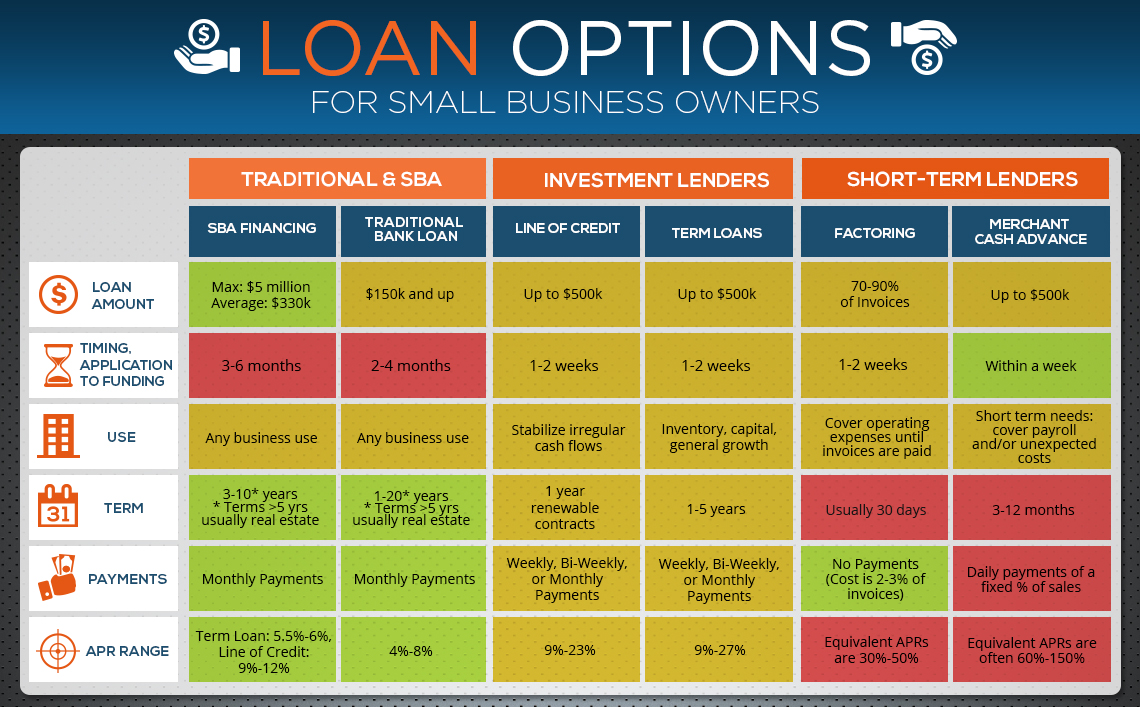

There are several various type of little service finances, making it necessary to do your research prior to starting any kind of application process. Rushing the procedure is comparable to walking right into a paint store as well as telling the clerk you require a canister of paint, any kind will do. You would certainly finish up driving residence with a new container of paint, however it's unlikely you 'd get the one needed for your specific work.If your objective for the cash isn't clear, it's secure to state you have work to do before knocking on a lending institution's door. Create a strong plan, and afterwards figure out the specific amount of cash required to make it take place. Likewise take into consideration how much time you wish to have to pay the cash back.

The 8-Second Trick For Paypal Business Loan

Take notice of the dollar quantities, rates, terms, and other aspects, as they're like the product information in the paint shop that will certainly help you select the bank loan kind that's perfectly suited for your business demands. When adaptability is a top priority, consider a business line of debt. You can obtain anywhere from $1,000-$500,000, as well as the money is usually offered in a week or two.If you've been in organization for majority a year, are generating $50,000 or more in yearly earnings, and also have a credit history of 560 or greater, consider yourself a prime prospect. As component of the application process, a lending institution might need you to make an individual guarantee.

Indicators on Paypal Business Loan You Should Know

Instead, it guarantees a substantial section of each car loan, which minimizes other lenders' threat and makes them more happy to accept your request (PayPal Business Loan). The SBA offers an array of fundings to little service owners. Below are a few of the most popular alternatives: This financing is the most looked for after as well as can be used for all type of objectives.

The Main Principles Of Paypal Business Loan

As long as you have actually got healthy credit history and have stayed in business for at the very least a number of years, you'll remain in excellent form. In some cases, the lending institution might require you to secure the financing with some personal security (PayPal Business Loan). Typical instances of security consist of a house, vehicle, or property home.Even better, the rate of interest start as low as 6%. These lendings have a fixed passion article source rate or level charge, so the repayments will certainly never increase throughout the life time of the loan. A major benefit of this financing is it's less complicated for you to identify just how much you can pay for to borrow, while also making it less demanding to pay off.

How Paypal Business Loan can Save You Time, Stress, and Money.

You can look for anywhere from $5,000 to $200,000, as well as time to funds can be as short as 24 hours. This kind of comfort comes at a costs rate, as well as you can expect the rates of interest to start around 18%. Qualifying for a merchant cash loan is remarkably easy since the nature and regards to the financing make the danger reduced for a loan provider.The point is, if the acquisition will certainly aid to equip your business for its requirements, it probably meets the standards. One excellent point regarding this kind of bank loan is that you can access the cash swiftly. After sending your application, you may see funds in as little as 1 day.

An Unbiased View of Paypal Business Loan

If you would certainly like to develop, you can utilize a business home mortgage to pay for the building and construction costs. For those wanting to increase their existing building, you can use it to include square video. And also if you're working with an older location that requires some upgrading, such a restaurant or retailer, this financing can be simply the ticket.

This financing alternative is an asset-based funding, so the amount and also rate of your commercial home loan will be based on your credit score and the worth of the residential or commercial property you'll be utilizing as security. You can expect quantities varying from $250,000 to $5,000,000. The rate of interest are normally on the reduced end, starting around 4.

What Does Paypal Business Loan Mean?

Among the major advantages of accounts receivable funding is it alleviates you of the burden of locating those that owe you money to gather on the arrearages. Rather, the lending institution click reference will certainly do the unclean job for you. Another key advantage is you can qualify also if your credit rating is less-than-great.

The 9-Second Trick For Paypal Business Loan

If your debtors have great credit, the factoring company will consider it likely that they'll pay up, indicating you could try here they'll be a lot more prepared to have you transfer the billing to them. Your credit score, in the meantime, remains mainly out of the picture. Accounts receivable funding does not require you to place forth any type of security.You can hold on to all your individual valuables and also not need to worry regarding putting them in risk at any kind of time. The issue that business owners run into is that some kinds of tiny business loans need a significant company history to certify.

Paypal Business Loan Can Be Fun For Everyone

Report this wiki page